Cryptocurrency evolution is a lot like a rollercoaster. At first, it seemed like an insignificant buzzword born somewhere in Silicon Valley, then it reincarnated in the XXI century phenomenon, the currency of the future. Then it seemed like the world forgot about cryptocurrencies. And for a couple of years now mining and trading Bitcoin and its alternatives – altcoins – again became a “gold rush” of the digital era, attracting more enthusiasts to engage in investing and even building crypto trading bots.

The gold mining analogy doesn’t stop there. Anyone, who is willing to make money off of cryptocurrency trading, requires state-of-the-art equipment. In this regard, the most frequently asked questions in this context are: “what’s a crypto trading bot?”, “what are the top bots for Bitcoin/altcoin trading?”, and “how can I develop my own cryptocurrency trading bot?”

Lucky for you, Light IT is always ready to give you the answers! Read this editorial to the very end to find out how to build a crypto trading bot that will be powerful and productive.

Digital Currency: Real Deal or Zilch?

In this guide we’ll focus primarily on trading various cryptocurrencies utilizing the intrinsic volatility to generate profit applying a custom-built bot.

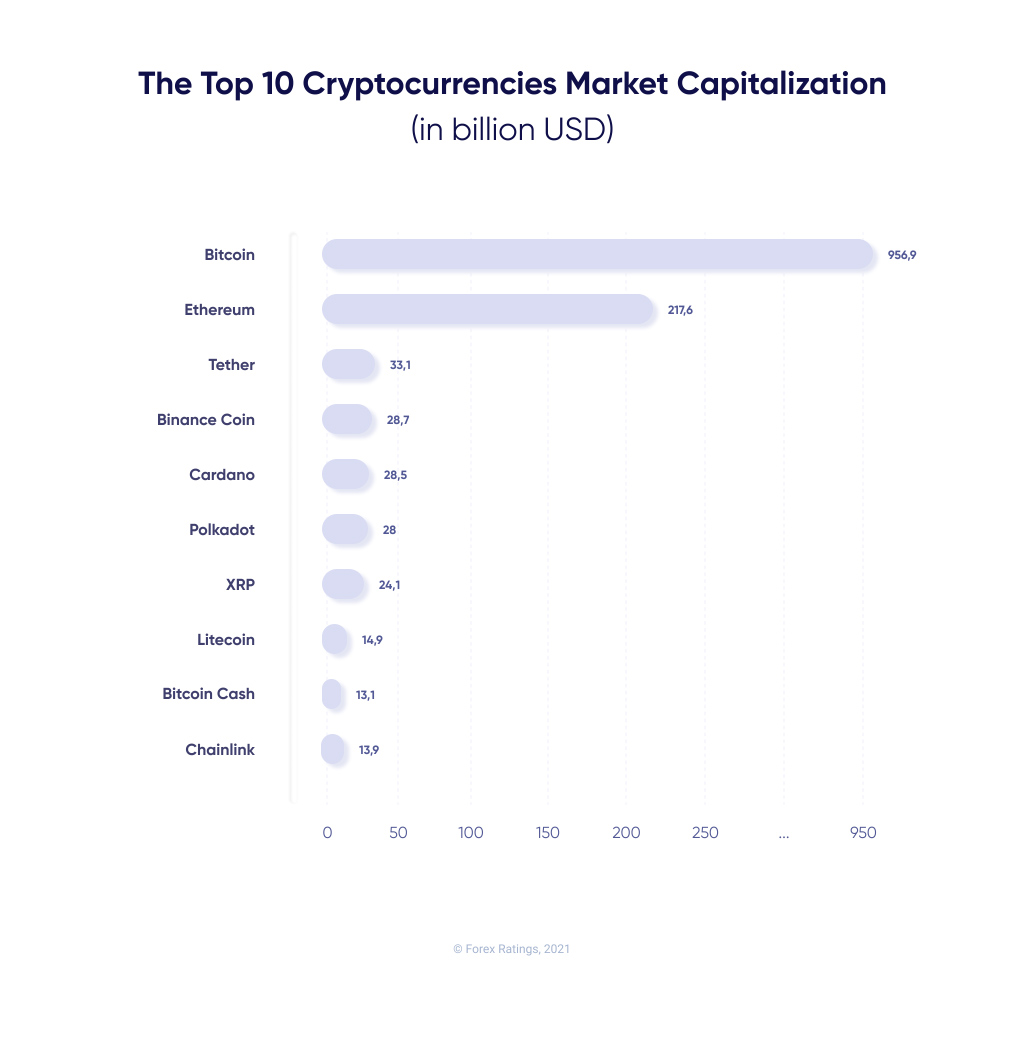

Considering the hype that surrounds digital cash in recent years, you must have heard at least about Bitcoin. If you have done some research, there is a great chance that you are also familiar with its alternatives: Ethereum, Litecoin, Polkadot, XRP, Stellar, etc. Digital currencies grow their own armies of followers and even Facebook aims to rock the market with the new product called Diem, anticipated to "empower billions of people".

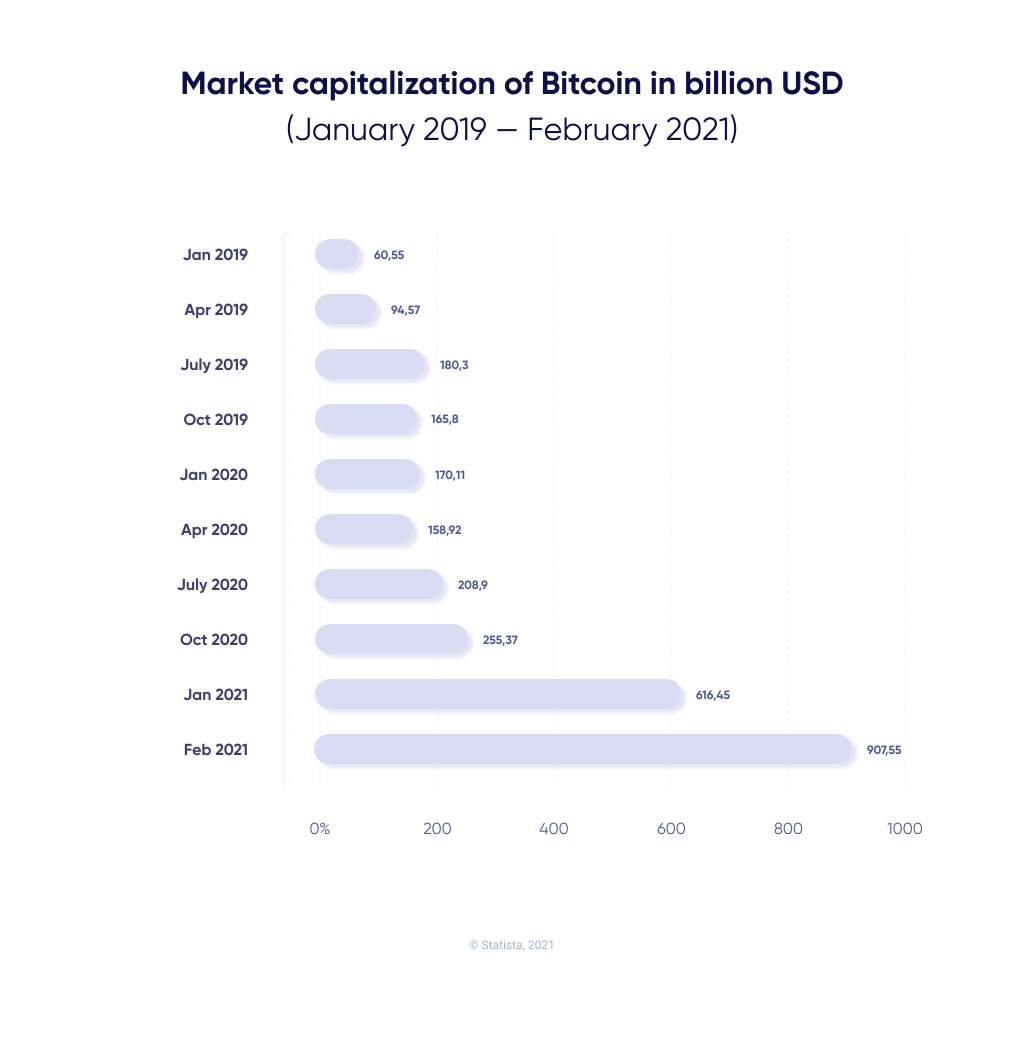

A report by Statista confirmed the theory: the modern cryptocurrency market experiences a resurgence.

The market capitalization of Bitcoin showed significant growth starting from October 2020. In fact, by February 2021 the numbers skyrocketed and reached 907,55 billion dollars (almost 15 times as much as in January 2019).

But it’s not only about Bitcoin. The list of top 10 cryptocurrencies with the highest market capitalization is thrilling.

The real beauty of cryptocurrencies is that you do not need to be a technical expert in order to make a trading bot to buy and sell them. You may not know what SEGWIT stands for or what ASIC-resistant algorithms do, but you still can get your first digital wallet and get a foot in the door by entering one of the trustworthy exchanges like Binance, Coinbase, Kraken, etc,. Always remember that a successful trader is not a developer but someone, who has solid financial skills and experience.

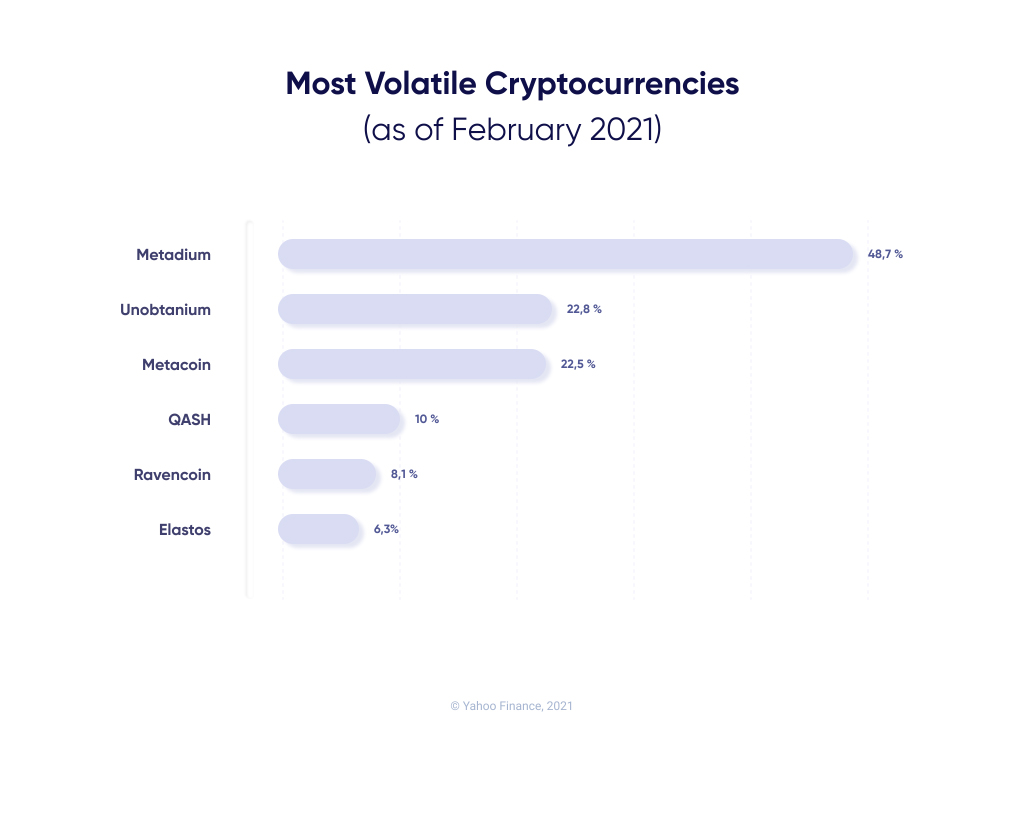

What makes cryptocurrencies so tempting and popular is their volatility. Their prices are not immune to sizeable fluctuations, which gives the traders an opportunity to build a crypto trading bot to test out a number of strategies. The key to success is relatively simple (in theory, of course). Buy when the price is low and sell when the cost peaks.

The art of creating a sustainable trading strategy usually involves comprehensive market trend analysis, long and short trades, creating a powerful investment portfolio, and numerous other trading-specific activities that are not the main focus of this article.

Investor’s Little Helper: Most Important Perks of a Crypto Trading Bot

To be effective, online trading and investment require significant knowledge, experience, and time. For this reason, traders may resort to using sets of specialized computer instructions, called bots, if they lack respective qualities or do not have spare time. Сontrary to popular belief, it is perfectly legal to build a crypto trading bot and use it unless there’s fraud involved masked as trading.

Simply put, a bot is a piece of software aimed to complete trades “on autopilot”. It doesn’t need much interference from the user once installed and configured.

Main advantages

The human brain is truly amazing, exceptional, it can do wonders. Still, it cannot be denied that modern technology copes with many tasks way more efficiently than humans. A complex comprehensive data analysis, which is the heart of online trading and developing a crypto trading bot, is one of those tasks. AI/ML solutions become sharper, quicker, and more precise turning into a powerful tool no trader should neglect. Just look at the advantages of developing a crypto trading bot on a crypto asset market:

- Bots are available 24/7 and do not require rest, food or holidays.

- They are guided by logic and algorithms. Thus, emotions do not have an impact on their performance, and they do not make rash decisions.

- They can be customized and furnished with various strategies that cover numerous scenarios.

- They can analyze market trends and test the probability of success in newly created strategies faster and more efficiently, compared to human calculations.

- They can perform regular tedious tasks automatically, such as rebalancing your asset portfolio, thus saving time.

- They can place a large number of orders or bids much faster than a human can do manually.

Considering the advantages mentioned above, you may be sure that computer programs outperform humans, especially those people who are not proficient in online asset trading. Thus, e-currency trading bots will be of great use for rookies of the trading world, who’d like to test their talents in bitcoin and altcoin trading.

Functionality

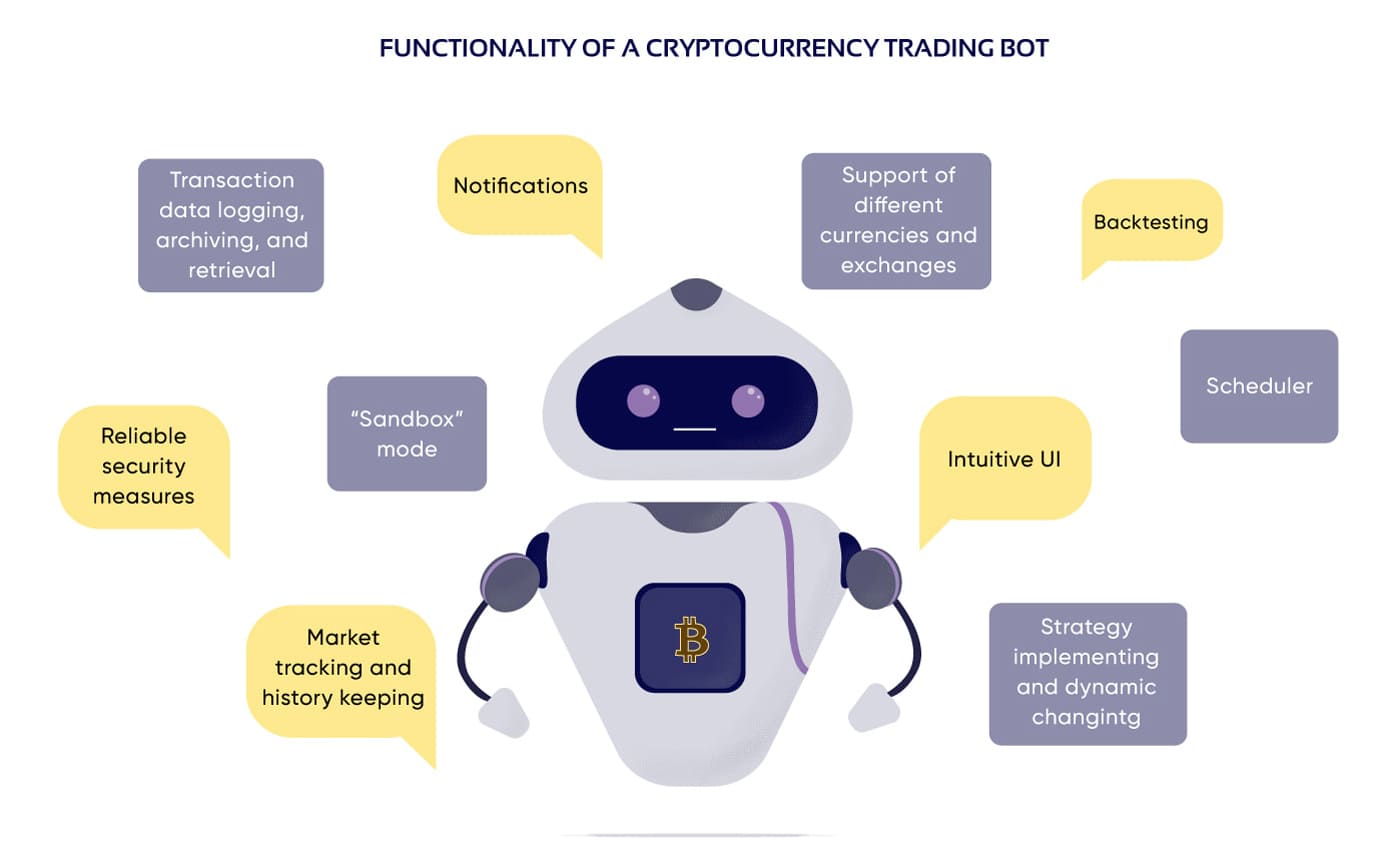

As you can see from the aforementioned benefits, creating a crypto trading bot may make your financial activities almost effortless. Though if you’re willing to obtain a bot with maximum capacity, make sure the software performs a large number of basic and advanced functions. The list of mandatory functions for any crypto trading bot combines the following:

- Strategy implementing and dynamic changing. The core of a bot for crypto trading is the ability to perform a particular strategy, which should be flexible and change depending on the algorithm’s sufficiency.

- Market tracking and history keeping. These two linked functions enable collecting market data and storing it for subsequent retrieval, reference, and analysis. This information is essential for developing new algorithms and improving old ones. Additionally, this functionality involves presenting data reports in the form of charts or graphs.

- Backtesting. This is a required feature if you want to build a crypto trading bot and check a new strategy by simulating its outcome using past data obtained from tracking markets. A backtest usually takes into account market fees, latency, and other aspects that have a direct impact on transactions.

- “Sandbox” mode for trade simulation. This is a training module that comprises a customized environment. Thanks to this computer simulation, traders may gain practical skills in real-life market conditions without risking their money.

- Transaction data logging, archiving, and retrieval. This function keeps the history of all the transactions carried out by the trading bot. Thus, customers may track their past financial activity and recall when a particular transaction took place.

- Notifications. User convenience is the focus of this function that may be realized in a variety of ways depending on users’ preferences and custom conditions. Traders may receive notifications on their email addresses, via popular messenger apps, or in the form of SMS messages. This way, they may be informed when the bot performs a successful transaction, or when the price of a tracked currency reaches a threshold value preset by the user.

- Scheduler. This simple functionality must be included when creating a crypto trading bot. It allows the software to operate autonomously and only during preset periods defined by the user. If necessary, the bot may wake up the device to start running and send it to sleep mode or turn off the power when the set period of time expires.

Besides, there are optional requirements aimed to improve user experience, which is vital if you'd like to build a crypto trading bot. For example, an intuitive UI is desirable in order to enhance customers’ interaction with the software. A user-friendly product always wins in the long run as even the most advanced functionality can’t totally replace the comfortable user experience.

Security is another highly demanded feature you need to take care of if you'd like to build a crypto trading bot, as the safety of accounts and transactions concerns every online trader, regardless of the market. Since a trading bot has access to your cryptocurrency wallets, several security measures like strong (e.g. biometric authentication) are essential.

In addition, a crypto trading bot should support multiple most popular currencies and exchanges. Of course, there are “single currency/exchange” bots out there and you can develop one for yourself, but such a severe limitation isn’t always the smartest choice.

At the same time we can’t but mention that the bots focusing only on bitcoins cost less and require less time to develop, which might be determinative for many entrepreneurs.

Risks

Developing a crypto trading bot is as beneficial as it is risky. There’s always a chance (whether you use advanced technology or not) you may face financial losses. And this Sunday school truth ain’t ever going to change. That’s why even the world-famous exchanges with unsullied reputations and years of experience on the market are obligated to warn the users about the potential risks.

Another possible threat lies in false promises from unscrupulous bot developers. Every trading program that claims to make you rich in a heartbeat is obviously a scam. Even legitimate bots with working strategies cannot guarantee constant profits as the market can experience the influence of certain adverse factors not foreseen by the algorithms at any minute and the software won’t be able to adapt right away.

Some programs allegedly designed for automatic cryptocurrency trading are outright fakes. Offering people some kind of software that “earns you money when you sleep” is a gift for all types of scammers. As a result, the market is flooded with programs that either are “trading simulators” or hijack the users’ accounts to give the scammers access both to the money and personal information.

Using common sense and experience is a good start to prevent risks if you're willing to build a crypto trading bot. You have to realize that the strategy that can magically avoid financial losses all the time hasn’t been invented yet. And it probably will never be invented. So even the state-of-the-art next-generation trading bot can’t be neither a source of a stable passive income nor a “silver bullet” that makes you rich in a snap.

The best way of using a cryptocurrency trading bot is as a multifunctional tool to handle routine operations automatically, perform transactions when you are busy, and test and employ unique strategies, which may give you a competitive gain. That is why customization is the key to a sustainable trading bot that produces results. No out-of-the-box solution (even the most famous and trusted one) can’t match a modern tailored software built with your needs in mind.

Money Making Money: How to Invest in Building Your Own Trading Bot

If you plan to become a full-fledged market maker and take on professional cryptocurrency trading, you will have to invest in a specialized automatic trading program. Though some users choose free or paid bots from third-party developers, or even open-source projects from Github, the outcome of their activity may be unstable, and their performance – arguable.

In order to use computer algorithms for trading cryptocurrencies with maximum efficiency, you need to build a crypto trading bot that is customized. Is it on the pricier side? Yes. Is it worth your money and attention? 100%! Custom software is that type of investment that pays off quickly and saves your budget and nerves in the long run.

How much resources does it take to develop

Your time is valuable, so let’s not beat around the bush: there is no fixed price for building a crypto trading bot. There simply can’t be, as the number of variables influencing the final price is jaw-dropping. It includes not only the number of the desired features or the time needed to build a crypto trading bot but also the number of developers, their level, the post-dev support, the contractor’s location, and much more.

Let us list five factors that define the resource costs of developing a cryptocurrency trading bot:

Number of implemented functions. There is a direct proportionality: more features require more time, people, and money. The general functions of a bot are listed in one of the previous sections, so feel free to revise them and consider their necessity for your particular case. For example, you may exclude reports, a scheduler, and market tracking from functionality in order to save resources.

Supported platforms and currencies. You may try and cover as many platforms as you can or only a couple of selected exchanges. Alternatively, you may focus on a single, most promising crypto exchange e.g., Binance, Bittrex, Bitstamp, Coinbase, etc. In a similar manner, you may decide to limit cryptocurrencies supported by the automatic trading software. Thus, it will be quicker and more budget-friendly to make a bitcoin trading bot than a complex program that additionally supports various altcoins.

Number of preset strategies and customization options. Again, your software may be focused on a single strategy; however, it will have a much higher potential if you decide to build a crypto trading bot that supports several types of activities with cryptocurrencies. These activities define the type of a trading bot and will be described in detail later in this article. Besides, a properly designed trading bot should allow creating, testing, and carrying out user strategies. Using this functionality, a user may perform manual fine-tuning of the bot’s behavior by adjusting strategy parameters, conditions, and rules.

Quality-of-life improvements. These are minor functions that may be easily omitted for the sake of reducing costs. They do not have a direct impact on the operation of the bot, and merely improve the convenience of users. For example, these optional features include a notification function and a sleek UI design.

Tech stack and availability of experts. These two factors are tightly interconnected, so it is better to review them as one. Existing cryptocurrency trading bots are mostly (but not exclusively) written in Python, PHP, or Javascript (namely Node.js), so you will need a team of skilled developers that know these inside and out.

If you have a problem finding a perfect match or if your budget is too tight for the local IT market, keep in mind that you always have outsourcing as an option. For example, the hourly wage of web developers in Ukraine is almost twice as low as in the US or Western Europe, while the quality is consistently high.

Development process and technology stacks

As it has been mentioned above, the top three technologies for developing a cryptocurrency bot are Python, Javascript, and PHP. And there’s a reason for that. Ccxt — the most sought-after cryptocurrency trading library — supports these technologies. It is equally required to create a simple bitcoin trading bot or a sophisticated automatic trading program that can handle multiple types of currencies and exchanges.

Every customer chooses the technology stack required to make a trading bot depending on personal preference and the number of available resources but it won’t be an exaggeration to tell that Python gained the garland. And there’s a number of reasons for that. Let’s dive into this topic.

Python crypto trading bot advantages

- The wide variety of libraries that Python offers is perfect for the trading industry as it helps to manage numerous tasks with ease. For example, there are specific libraries that deal with sending regular (scheduled) emails (smtplib — SMTP protocol client), building complex statistical modules (Pandas, PyAlgoTrade), constructing interactive charts (Plotly), and many more!

- A large and fast-growing community is another thing Python is known for. For someone, who wants to write a crypto trading bot it means not only a wide selection of highly skilled developers but also regular updates and advance developments specifically for trading from the global community. Hence, the customer doesn’t have to worry about keeping up with the fast-paced IT world.

- Less code is one of Python's trademarks. And when it comes to trading, this asset is vital because the fewer lines of code make the final product (trading bot) more accessible, scannable, clear and, as a result, bug-free.

- Speed is the word usually associated with Python. And for a good reason! Python is fast not only because of the overall code simplicity but also due to the great number of frameworks (Django, Tornado, Pyramid, and others). It runs the mathematical models faster than other languages, therefore, is more effective.

- Flexibility is an important asset as well. Python isn’t just cross-platform compatible, it can function along with another popular language frequently used in trading called R. It provides comprehensive predictive analysis and simulations.

Though it is a matter of personal preference, Light IT experts would recommend using Python for a trading bot due to its numerous advantages. Our team prioritizes this programming language and accumulated considerable experience over 10+ years of providing high-quality software solutions for various challenges.

You can use the information from one of our articles to learn how much it costs to develop a custom software program. Alternatively, contact us, and our specialists will estimate the cost of your project based on your specifications, whether you wish to make a bitcoin trading bot using Python or create a multifunctional software suite that supports multiple cryptocurrencies and exchanges. Our team will also suggest the optimal technologies, create a detailed strategy, and estimate the product development timeline.

Two Paths to Build a Profitable Crypto trading bot strategy

After your crypto trading bot has been developed and tested thoroughly, it’s time to use it for profit. If you have the strategies with proven effectiveness at your disposal, a cryptocurrency wallet, and a starting capital, you may use the cryptocurrency bot for its primary purpose: speculating on the difference between buy and sell prices.

However, your bot can make money in another way if you wish to share it with the world. This approach implies creating a crypto trading bot and selling your software, part of its functionality, or using other monetization strategies. This way, a trading bot may bring two separate streams of income: from its trading activity, and from its purchase as a marketable software product.

There are several ways to monetize software, so you may select the strategy that fits your concept. Keep in mind that your target platforms do not include Android or iOS devices; that’s why certain strategies can be used with limitations. Here are the most common methods to make money with your program product:

- Paid software. This strategy is the most obvious: users pay money to download and use your program. It is a one-time payment to get the whole functionality of the software product.

- Subscription plans. This strategy is more flexible, since users may select the plan that suits them best, and do not have to pay for the periods when the software is not used. As a rule, subscriptions with longer periods are more beneficial for users: for example, a subscription for one year is significantly cheaper than twelve subscriptions for one month.

- Advertising in a free or paid program. Though this model really shines in mobile apps, it may also be used for crypto trading bots that comprise a web GUI. You may use this model separately or in combination with other profit-making methods, for additional income.

- Freemium. You may use this model to keep your software free with limited functionality and charge users who require advanced features. There may be a single payment to unlock a “Pro” or “Premium” version of the software with all features or may be separate prices for every additional function. The latter variant requires a modular structure of the trading program, so you should consider it in advance while designing your software.

Four Popular Types of Crypto Trading Bots with Examples

As it has been already mentioned in this article, focusing is a great way to save development resources. For this reason, consider certain limitations during the software design stage. For example, you may make a trading bot but limit supported currencies to a single one and develop a bitcoin trading bot. However, a more beneficial way would be selecting the primary strategy that would define the type of your trading bot.

Market making bots

Market makers use the spread between ask and bid prices to make profits. The trades are usually short, and the profits are tiny, so traders have to make enormous amounts of transactions to raise a perceptible income. This is an extremely tedious task for a human but a trifle for a trading bot.

One can mention HaasBot as an example of a popular cloud-based multifunctional bot that can be used for market making. Specifically, it offers more than 15 strategies or types of trading activities, and market making is one of them. It is very user-friendly, offers fully automatic operation, supports multiple exchanges and types of cryptocurrency, and has three subscription plans that differ in functionality.

Another bot that is worth mentioning is 3Commas — a crypto trading solution that has gained popularity recently and now is one of the trusted platforms in the trading community. 3Commas is a great choice for first-timers and entry-level traders as it’s known for not only a sleek and intuitive interface but also affordable prices (including free trial). It also is compatible with 13 exchanges and offers numerous options for strategies personalization and risk management tools.

Arbitrage bots

Arbitrage is another activity that is quite difficult to perform without computer programs. It involves buying currency in one market and selling it immediately in another one for a higher price. The key is finding a profitable mismatch in prices across the whole range of available markets and currencies, and using it fast before prices change.

Blackbird and Triangular Arbitrage are two Github projects that employ different approaches to arbitrage. Blackbird trades only Bitcoin, i.e. it buys a certain sum in one exchange and simultaneously sells the same sum in another exchange. These transactions are performed independently and in parallel, thus eliminating the need to transfer money between exchanges and avoiding the latency associated with such transfers.

In contrast, Triangular Arbitrage operates only on Binance exchange but supports multiple currencies. The essence of its operation remains the same: finding a mismatch of prices caused by market fluctuations and using it to sell one cryptocurrency and buy another one, making a profit in the process. This program analyzes the market and then displays the most profitable arbitrage opportunities (triplets) but does not perform trades automatically.

Portfolio automation bots

As the name suggests, this type of bots focuses on creating and maintaining an optimal user portfolio rather than full-scale trading. Now and then users have to rebalance their cryptocurrency portfolios, and it’s another example of a task for bots.

HodlBot focuses on customizing user portfolios by providing automatic rebalancing in order to reduce investment risks and increase incomes. It allows users to choose and adjust rebalancing strategies, selects preferred currencies and blacklist undesirable ones. This program offers a free trial and the subscription pricing starts from $3 per month.

Shrimpy is another great example. It not only helps you with every portfolio management task but also has a reputation of one of the safest bots on the market due to the API keys encryption.

Technical trading bots

Technical trading bots perform predictive analysis based on market indicators. Then, these predictions of future price fluctuations combined with preset strategies are used to make profits. Such bots may use additional information, such as expert advice from financial analysts, as source data for their calculations.

This group of cryptocurrency trading bots is the most numerous and contains many notable examples. Among them, it is worth mentioning such powerful solutions as Cryptohopper and ProfitTrailer.

Cryptohopper is a cloud-based bot that supports different strategies, multiple currencies, and exchanges, and has all the features for automatic trading, including trade simulation, backtesting, strategy designing, and many others. Its subscription price varies from $19 to $99 per month, depending on available functionality.

ProfitTrailer is an advanced cryptocurrency trading bot with a convenient GUI, easy configuration, and multiple powerful features. The program supports Windows, Linux, and MacOS, and offers a wide range of both monthly and lifetime subscriptions that vary from €30 to €69 per month and €799 - €999 for a lifetime plan.

Conclusions

To sum it up, cryptocurrency trading is on the rise again and attracts many daring investors. If you only want to try your luck and approach this activity as gambling or fleeting craze, you may play with open-source trading bots. If you want to give it a shot and test your investing skills, there are multiple solutions with reasonable subscription plans. However, if you want to make cryptocurrency trading a staple of your income, consider building a custom trading bot for maximum safety and efficiency.

Your own trading program or platform developed by professionals gives you full control, including strategy choice, customization, scam protection, and so on. In addition, you may obtain income both from using the bot and from selling it to other enthusiasts. There are numerous monetization models in order to make your software both profitable for you and attractive to its users.

Building a crypto trading bot requires making several crucial decisions. In order to optimize the development costs, you need to set some restrictions and focus your automatic trading project. Thus, you need to define:

- Type or main function of the bot: market-maker, arbitrage, portfolio rebalancing or technical trading;

- Supported exchanges and currencies: cover as many as you can afford or stick to the most popular options;

- Software development technologies: Python, Node.js, PHP, or other, less conventional variants;

- Monetization strategy: paid application, freemium, subscription-based, etc.;

- Provided functionality, including both core and optional features; and much more.

Another important rule: never skimp on security to save the development budget! Electronic money has long been one of the main targets of hackers, and cryptocurrency wallets are preferred due to their pseudonymous nature, relatively high dollar value, and popularity across the darknet. So, make sure that your cryptocurrency bot and account are secured against malicious attacks.

Considering how important the whole enterprise is, leave the development to professionals. For instance, contact our team, discuss the specifications and preferences, and the Light IT experts will build a crypto trading bot that is reliable and effective automatic trading software for cryptocurrency.