Along with other industries, the banking sector also strives to adopt modern methods and integrate digital technologies into its operation routines to achieve maximum efficiency and profitability. While being extremely beneficial and having strong potential during our digital age, this complex set of measures demands a careful and calculated approach, especially in the field of financial services that involve significant funds and high risks.

Let us take a close look at this process and discover why a digital transformation banking strategy is essential for its successful realization.

What is digital transformation in banking

If you’re wondering what is digital transformation in banking, in this context, digital transformation (DT) means multiple changes in the banking industry performed to integrate various fintech solutions in order to automate, optimize, and digitize processes, as well as increase data safety. This process implies multiple large and small changes that reshape the methods and technologies used in the financial area.

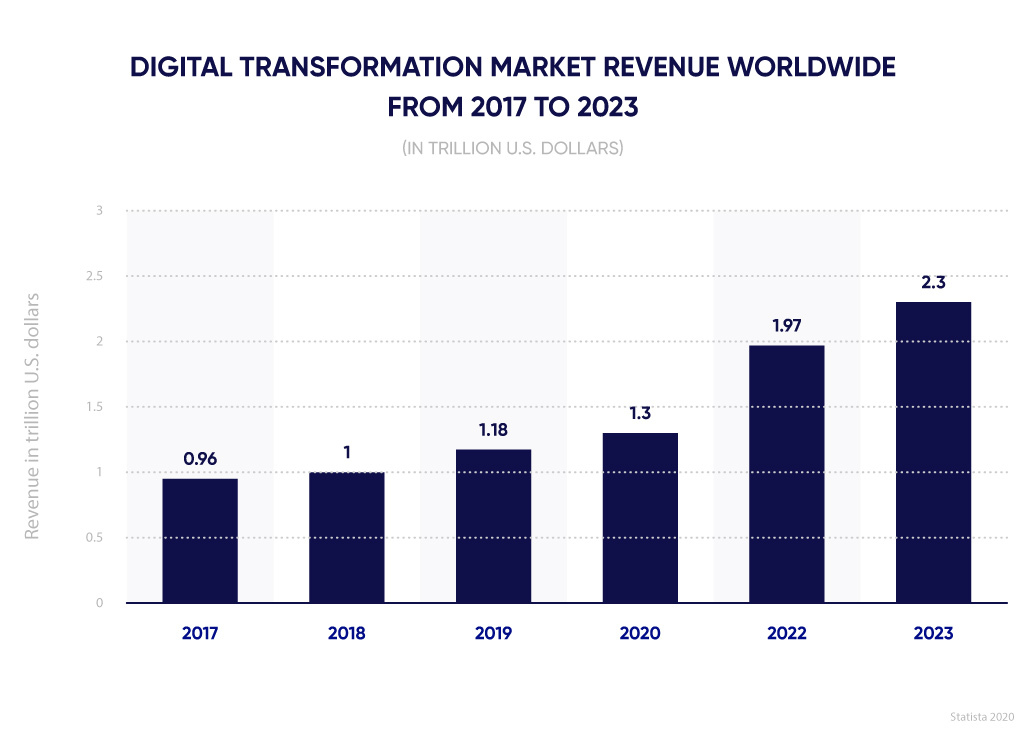

Regardless of industry, the primary trend of digital transformation is the integration of computer technologies, and Statista shows us that this trend is on the rise.

Depending on the entity’s type, target market, audience, and business strategy digital transformation may and will differ. However, banking (weather it’s digital banking or a traditional operating model) has several specific characteristics that define the priorities, goals, methods, driving forces, and other features of the DT peculiar to the financial area.

Digital transformation in investment banking

Investment banking in many ways has become the definition of traditional banks. This financial services sector typically includes large financial institutions that serve governments and big corporations, deal with the business sector, and big sums of money. Such intense and high-risk activity can sometimes transform into even greater losses for a bank or another financial institution. In fact, without smart digital transformation, investment banking is doomed to fail because of the growing complexity of fraudulent schemes and equally growing competition in the Fintech market.

Fraud detection of startups

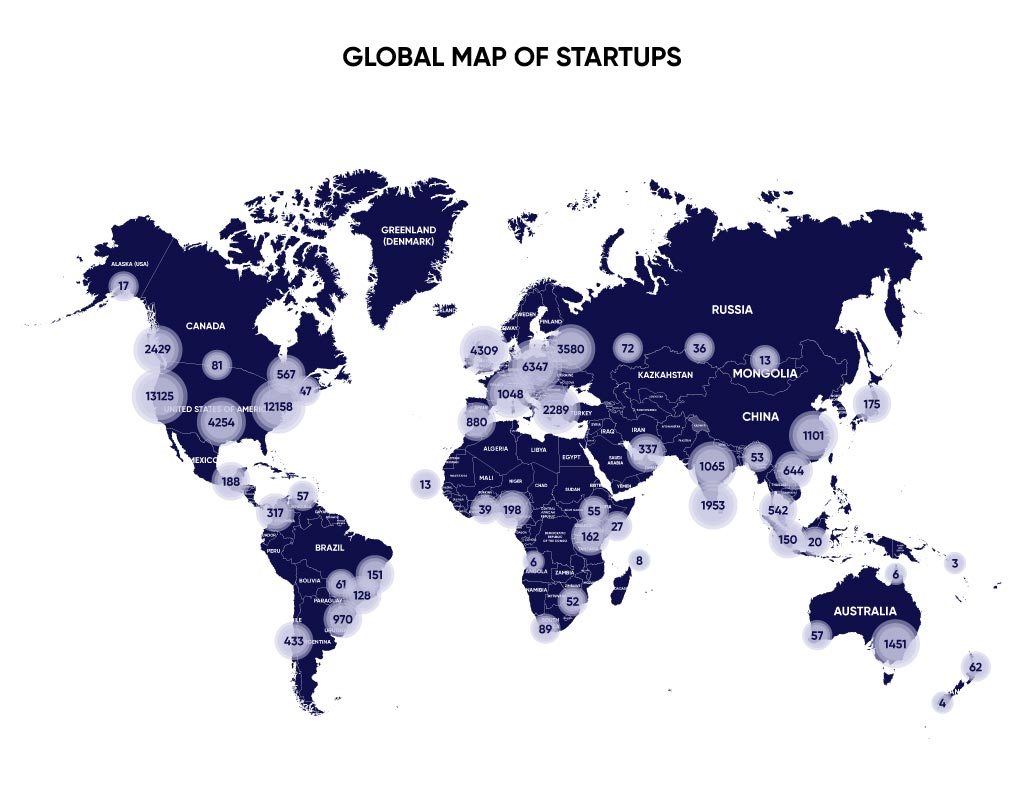

While there’s no accurate statistics on how many startups are there in the world today and how many emerge each year, the number is most definitely in the hundreds of millions. Without proper fraud detection software, traditional banks as well as digital platforms providing financial services can never know whether they’re looking at a promising startup that will turn into a unicorn or another fraud that will disappear right after they get the investment money.

Banking institutions invest in their own custom fraud detection systems, and the ones that already use them have vastly reduced or even fully eliminated the risk of giving loans to frauds. These systems include Artificial Intelligence or Machine Learning elements, and the precision of their results fully depends on the quality of calculating and risk management modules as well as software implementation.

Big Data

Big Data is used by investment banking institutions mainly for fraud detection, forecasting, and analytics. Big Data, in combination with Machine Learning, can facilitate successful digital transformation and protect your financial institution—a bank or credit union—today by detecting frauds, customizing offers for every client, simplifying operation of legacy systems, increasing the safety of transactions, and overall improving customer experience. This information also helps in building and adjusting a customer journey map to improve the customer satisfaction and retention of clients by meeting customer expectations. Besides, this combination can protect your Fintech business tomorrow by giving predictions on future changes. Thus, you can gain a competitive advantage by being more careful with partnerships, loaning decisions, staff hiring, etc.

Market modeling and analysis

Analytics software is crucial for all companies in the banking sector regardless of their operating model. The digital transformation that is actively happening in all industries changes the conditions for the banking sector as well. And these changes are rather rapid, leaving behind all the market players that aren’t able to adapt quickly enough.

A good-quality analytical platform can present you forecasts for the next few years, months, and even decades. It will give you an opportunity to adjust your business strategy and switch from less effective traditional operating model to one of the highly competitive digital operating models. Or it might show you that you’ve already chosen the right development direction and you should stick to it. Depending on the type of your software and input information, you can get multiple future market modeling scenarios.

Digital transformation in retail banking

Unlike the investment banking business, retail banking deals with the B2C sector and has its own difficulties and peculiarities that can be easily solved with a proper combination of software and hardware and precise digital banking transformation.

Fraud detection of individuals

When a manager checks a loaning request, it may take from hours to days, and there is no guarantee of missing out on some vital information, which results in a bad decision for the banking institution and poor customer experience with said institution. However, banks that have integrated KYC (Know Your Customer) digital technology get the validation process done within minutes and make decisions of significantly better quality.

Depending on the access to official databases, you’ll be able to check and validate clients on their administrative and credit history and optimize your loaning and other financial processes. In some cases, the information scraped from open profiles in social media and other similar digital channels can also help to identify frauds.

Big Data

Being large financial institutions, retail banking deals with thousands of clients and their transactions on a daily basis. Big Data solutions will help you to enhance your capabilities and increase client satisfaction and retention rate. Clients expect their payments and all kinds of requests to be processed immediately. When the system makes them wait for minutes, it is a bad customer experience resulting in your clients switching to the digital services of your competitor.

Internet of Things

Internet of things integration as a part of your digital transformation will make processes related to customer service and customer experiences as optimized as they can ever be. For example, a customer tracking system will collect data on the movement of your customers and staff, process it, and show areas that need improvements or rearrangements to increase the quality of banking services.

IoT also helps to customize offers and start mutually beneficial partnerships with companies engaged in other industries. For example, your IoT system can track that your bank client browses a specific car model and has already visited a car dealership at least once. After the KYC system confirms that this client has a good history, you can send the client a customized offer in the form of advertising, telling about your “new” car loaning program. As a result, you can not only put more effort into creating a better customer experience without having to allocate more budget for that but also get better outcomes in terms of profit.

Digital Transformation in Corporate Banking

Just like the investment banking sector, corporate banking is focused on providing different types of financial services to corporations and large institutions. The difference between them lies in the array of services provided and the type of bank-customer relations such entities create. Corporate banks are typically dedicated to forging stable long-term partnerships and are less transactional than investment banking. In this regard the matters of digital transformation in financial services and keeping up with high customer expectations are more important than ever.

AI/ML for Simplified Onboarding

A survey conducted by Finextra pinpointed that 39% of corporate banking clients consider the onboarding process to be too slow. And this has a major negative impact on the customer’s perception and their first impression of the bank. A well-thought-out digital transformation strategy supported by multiple digital channels can fix that issue relatively quickly.

For example, the introduction of smart chatbots can not only take the load off the staff by granting 24/7 accessibility, but it can also streamline the process of client data accumulation.

Another example is AI/ML-powered intelligent document processing. Digital innovation like optical character recognition, data capture or text forms auto-filling are capable of increasing operational efficiency and keeping onboarding short yet complete.

Modern banks understand the power of an extensive digital environment, and, as an ABBYY survey shows, 44% of businesses have either digitalized onboarding completely or added at least some technology to the process.

Robotic Process Automation

The automation of repetitive tasks that are also typically manual is one of the main goals of digital transformation in banking and financial services. Corporate banks aren’t unique in this regard. However, corporate banking is the sector that may and will benefit from robotic automation probably the most.

RPA can be used by corporate banking market players in many ways. It, among other tools mentioned in the section above, can help with onboarding, loan processing, customer acquisition, account management, and general ledger. Process automation also facilitates effortless team scaling in case of high demand, which, once again, caters to customer needs.

Blockchain

Blockchain technology is truly multifunctional when it comes to banking. Blockchain-enabled software can be used by modern banks to execute smart contracts, perform operations with securities and international transactions, work with digital wallets and currency, better protect customer data, and achieve regulatory compliance.

Another way to introduce Blockchain in digital transformation for banking is to use this technology to strengthen data security measures. Blockchain offers a secure way to perform quick and traceable transactions that require no additional intermediaries. Cryptographic protection, on the other hand, keeps identity verification as safe as possible.

Multichannel customer experience

Lack of connectivity is one of the main struggles of corporate banking clients. That is because relationship managers are often considered to be the one and only source of sales and customer support in traditional banking systems. Digital transformation in banking is the way to fix this flaw. Several communication channels that are available to the client simultaneously shape a positive customer experience and create an image of a reliable financial partner.

This doesn’t mean that relationship managers suddenly become irrelevant once digital banking transformation kicks in. On the contrary, their importance and efforts become even more prominent as professionals have more time to build stronger connections with each client once the load is taken off of them.

There’s no one ultimate way to create this digital world your clients will love. Each business owner has to invest time in developing an ecosystem that will rely on the combination of traditional banking, mobile banking applications, and online services to remain competitive.

Advantages and disadvantages of digitization in banking

Digital transformation offers the following benefits to financial institutions:

1. Improved security on all levels of financial data and customer data handling. Data encryption saves banks from external and internal leaks of information to frauds and competitors. Most importantly, it increases the safety of transactions.

2. Faster operation and lower waiting times. Clients don’t like to wait, especially when they trust your bank with big sums of money. Big Data processing systems with microservice-based architecture ensure fast and safe transaction processing without compromising security or integrity.

3. Better analysis and risk management for banking operations. You won’t have problems with fraud schemes if you have good fraud detection systems implemented as a part of digital transformation in banking. Also, multi-level validation of transactions will eliminate the possible mistakes of your customers and your staff.

4. Predictive capabilities. Knowing in advance what problems and transformations your market will face in the future is one of the key factors in the financial success of many banks, if not all of them. Having trusted information on different possible scenarios, from minor stirrups to a global economic crisis will help you to prepare in advance. This way, you can make the right business decisions and integrate winning Fintech solutions before your competitors or switch your business to another more promising and financially rewarding industry.

5. Customization. Customers hate receiving standard offers they don’t need but are positive about receiving timely offers aimed at solving their particular needs. The financial services industry is no exception in this regard. If you invest in the software with the right analytical, data mining, and processing compounds, you will be able to customize your offers and make this flow automated and safe.

6. Automation of repetitive tasks. When managers extract the same information to build the same reports over and over again, it is mindless and inefficient labor for your staff and your company because you’re paying salaries for something that is done by the people for hours or days and can be done even better by digital transformation solutions within seconds.

However, these benefits have their price, so here are some drawbacks of digital transformation in the banking industry.

1. High risks in case of poor implementation. Banking is one of the few business areas that involve risks of extremely large financial and reputational losses. That’s why all digital transformation initiatives in this area must be carefully planned, modeled, and tested. The main goal here is to prevent any disruption of the existing flow of business processes and complete the digital transformation in banking institution as seamlessly and safely as possible. Otherwise, vulnerabilities may appear that lead to leaks or loss of confidential information or a chance of unauthorized access to bank accounts.

2. High requirements for hardware and personnel. Digital technologies need highly skilled specialists to implement them in the most effective way. Moreover, hardware and software used to perform digital transformation in banking become obsolete over time, and businesses have to replace legacy systems with modern alternatives that offer relevant digital features. For banking, the stakes and the requirements are much higher than in many other industries.

3. High costs. With such high requirements for digital transformation, banking demands cutting-edge technologies and the best specialists available on the market. As a result, significant costs are involved. However, high expenditures on top-quality digital platforms that are functional and easy to use result in bigger income and a higher level of safety.

Examples of Software Solutions for Banking

Banking institutions will benefit from implementing the following solutions in terms of their digital transformation strategy:

- Fraud detection system

- Know Your Customer software

- Big Data analytics platform

- Data Encryption

- Big Data mining and processing software with a microservice-based architecture

- Modeling and simulation software (for predictive analytics needs)

- Data generation solutions (banks don’t share their information with other financial institutions; thus, many banks face problems with getting enough data for machine learning purposes like creating fraud detection systems)

- Virtual assistants

- Customer acquisition software

- Online banking applications or other form of digital banking

Complex digital solutions may be costly, but when it comes to banking, there’s no room for a budget decrease in custom software development and digital transformation efforts. The most well-known banking leaders started their digital transformation years ago and now openly tell about their success. If you, as a banking industry player, would like to remain competitive, embrace digital transformation.

For example, Bank of America reported that by the end of Q2 of 2020, their AI-driven virtual assistant Erica completed 160 million client requests and reached 14.4 million total users. And in 2023 Erica had about 2.1 million users every month (the number of interactions grew by 35% compared to 2022).

Technologies

Modern banking is mostly associated with Big Data. For this reason, most technologies that are actively implemented during the digital transformation of the financial sector are highly beneficial for collecting, processing, storing, and analyzing large amounts of information. Here are 4 most popular types of computer technologies used in digital transformation in banking:

1. Artificial Intelligence and Machine Learning. AI and ML are powerful technologies, even when they are used separately. However, their synergy multiplies their effectiveness if they are used in combination to facilitate digital transformation in banking and improve operational efficiency.

2. Blockchain. While this technology is mostly associated with cryptocurrency, it is used in banking for its extremely high-security features. It ensures safe storage of data and protects it from tampering. Moreover, Blockchain-powered digital technologies utilized to execute smart contacts, perform asset tokenization, streamline cross-border transactions within traditional banking systems and digital banking, enhance trade finance processes, and more.

3. Cloud Computing. In addition to personal data centers and warehouses, financial institutions also use a wide range of cloud-based services to speed up and simplify digital transformation in banking. Due to its scalability, flexibility, and cost-effectiveness, cloud computing provides all the necessary capabilities to execute advanced data analytics, securely store and manage sensitive customer data, and safeguard business continuity. In terms of digital transformation in banking, cloud computing makes it easier for business owners to develop and incorporate innovative digital services, be it web-based software or mobile apps.

4. Internet of Things. Smart devices are the best way for enterprises to learn about their current and potential clients, and find out their needs and desires. The banking industry uses personal information not only to provide more tailored digital services but also to create customer journey maps. Such data is also used to develop and adjust banks’ marketing strategies using targeted advertisements.

Personal information collected using the IoT is also used as a source for further analysis performed with Machine Learning to find customer behavior patterns and train Artificial Intelligence to recognize subtle signs of fraud, so incorporating IoT-powered software can be extremely advantageous for entities willing to complete digital transformation in banking, especially if it is a network of banks.

Conclusion

As in most industries, digital transformation in banking is a very expensive set of measures. A financial institution must consider this fact and prepare the full amount of resources required for the successful implementation of digital banking technology.

If you want to maximize the benefits of digital transformation, you need a comprehensive strategy and skilled specialists. Contact us, and we will perform all stages of integrating digital technologies into your enterprise. We understand the high requirements in this industry and have the skills, experience, and discipline to provide top-quality realization and flawless results. Light IT Global has many Fintech projects under its belt, we know how to create fully compliant comprehensive solutions that will meet all of your business needs and will be appreciated by your customers.