To a non-specialist, stock trading looks like a chaotic whirlpool, but to a professional, it is an orderly system with recognizable patterns. These characteristics make stock markets an excellent field for implementing AI and ML technologies in order to perform a comprehensive analysis and accurate predictions of stock price fluctuations. This article covers possible ways of using Artificial Intelligence for stock market trading and outlines the benefits of such uses. It also describes the most advantageous and demanded features that are essential for turning such solutions into the best AI trading software available in this business. We will also review how to make such AI solutions more secure by designing and implementing specific features during the planning and development stages.

Benefits of Using Artificial Intelligence Stock Trading Software

Artificial Intelligence changes this world in the ways you cannot even imagine. Along with medicine, education, and many other sides of life, it changes the rules of stock trading. The usage of AI in this area opens many opportunities and possibilities for reducing the risks and maximizing the financial rewards of both quick trades and long-term investments. Here are several benefits of using AI stock trading solutions that make them a wise advisor for novice traders and an extremely powerful tool in the hands of experienced investors.

- 100% cold-blood logic, 0% emotions. Artificial Intelligence eliminates performance losses due to bad mood, health issues, as well as failures due to a human error. The emotionless approach is a serious flaw in creative activities but is a huge benefit in the field of finance.

- Reduced time required for research. Modern CPUs can execute billions of instructions per second, which provides incredible computational power that vastly exceeds human capabilities.

- Less money spent on staff and office. Increased productivity, combined with the automated nature of AI stock trading solutions, results in reducing costs on personnel and rent. Though computer systems require certain operation costs, most notably – on hardware or cloud services, they also allow reducing the staff of data analysts, advisers, statisticians, brokers, and other personnel to the indispensable minimum.

- Fast report generation and convenient charts. The use of AI software allows minimizing the amount of paperwork by generating various types of customized and illustrative reports and charts with different options to filter displayed results. Such reports may be easily generated on demand, displayed on monitors, and updated in real time.

- Constant evolution of AI. Artificial Intelligence is constantly evolving in two different directions. On the one hand, the development of AI technologies results in frequent releases of new, more effective Neural Processing Units. On the other hand, the AI algorithms employed in a particular stock trading system are continuously learning and improving their accuracy and efficiency.

- Automation of processes. AI system is capable of performing various sets of tasks in an automatic mode, so it does not require constant human supervision and coordination in order to sell stocks or invest in them. A properly developed AI stock trading system with carefully selected settings and tested algorithms can be employed as a “plug in and forget” solution. It will require periodic maintenance and checkups but is capable of operating as a passive source of generating profits

- Combinability with modern technologies. AI works even better in combination with other digital technologies, such as Big Data or blockchains, to handle large amounts of data and ensure its safety, as well as secure operation of the AI trading system as a whole.

How to protect your money while using AI in stock market trading

Considering the risks involving large amounts of money, developers must think thoroughly on how to prevent customers from losing huge sums due to AI faults or errors in machine learning patterns. However, these risks can be mitigated or completely prevented with the help of competent developers by adding several safety features to future AI software.

For instance, the first safety feature you should envisage is a “kill switch” – a fast way for a product owner or any user with the highest level of permissions to abort all operations or shut down the whole system. It is a drastic yet highly effective measure to prevent potentially lethal damage to your business and reputation.

Blockchain. Combining blockchain technologies with AI stock trading software is an effective way to secure confidential data in order to prevent leaks or tampering. Moreover, blockchains may be used for preventing loss of information by ensuring reliable storage of raw and processed data.

Restrictions. Any software that handles huge sums of money must have multi-tier access with different user rights and permissions. Consider carefully the extent of your managers’ access to the software’s functionalities and data depending on their roles, skills and qualification. Needless to say, full access must be given to the people you trust entirely. You must also implement certain network restrictions to reduce the possibilities of unauthorized access to your system from the outside. Equally important, you need to determine restrictions related to AI-driven decisions, and whether those decisions require confirmation from system administrators.

Limitations. Even though we are talking about top-quality software that is basically a fully-functional ecosystem, you still better develop as much protection as you can. Malfunctions happen, and since you never know when this moment comes, you need to be fully prepared beforehand. Since Artificial Intelligence has outstanding capacities, you better include limitations on:

- daily or monthly number of deals;

- maximum budget for a deal;

number of simultaneously processed deals, etc.

Constant self-checking. Money and health are two essential things that must be monitored continuously. Providing continuous status monitoring of the AI system may be costly and require hardware and software that can handle high-load data processing, but financial safety should always come first to avoid even the slightest malfunctioning.

Improved alerts. Though AI stock trading software can (and should) operate automatically, without constant human interference, it must be equipped by an advanced notification system with the option to send report messages via e-mail or SMS. Such messages may include notifications on stock price fluctuations, stock price reaching a preset threshold, trades that yielded no profit for any reason, any signs of AI malfunctioning, and so on.

Another important thing to remember: the more AI software is out there, the less effective it gets. More and more often, stock traders face the paradoxical situation resulting from the abundance of AI-enhanced software. On the one hand, Artificial Intelligence reveals logical patterns in a chaotic field of stock trading. On the other hand, automated trading brings more chaos to stock markets, as AI software disrupts the very same “natural” patterns it learns from, making it more difficult to predict the stock price fluctuations in the future. However, AI solutions are getting more intricate and will definitely take this conundrum into account.

4 ways of making profits with AI stock trading software

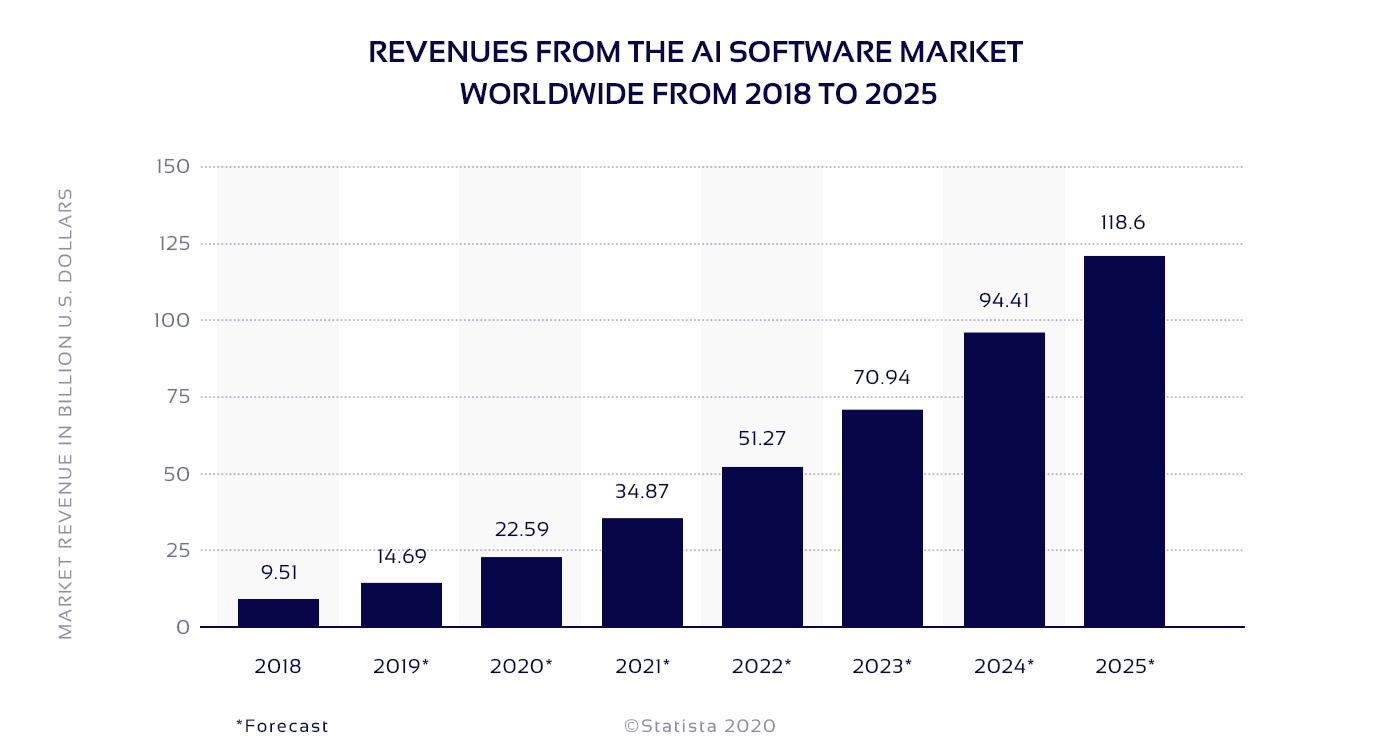

For an owner of AI stock trading software, there are several strategies of turning its product into a reliable source of profits. While using AI for stock trading is a potentially profitable activity, the development of an AI-enhanced software application for sale is also a viable strategy, considering the continuously growing demand for such solutions and Artificial Intelligence software in general. Let’s consider the possible ways of making money with AI software for stock trading.

1. Developing custom AI software for personal use.

This path involves building an AI stock trading solution for a personal enterprise such as a stock trading company or investment fund. As they say, if you want to do it right, you have to do it yourself. This way, you have the ultimate control over the stock trading solution built according to your specifications. You are the sole owner, so you may create, customize, and improve machine learning patterns and trading strategies as you see fit. For example, you may envisage specific sets of trading algorithms combined into selectable types of program behavior: extra cautious, standard, risk-taker.

On the other hand, you will be the only one responsible for the success or failure of the whole stock trading endeavor. Remember: an occasional bad trade or failed investment due to a tanked price are not the reason to quit this business. However, if failures become a tendency, you should reevaluate and adjust the trading strategy and machine learning algorithms.

2. Developing a simple AI software product for sale.

One of the most common activities for novice traders is the so-called “day trading” when the trades are short, and the source of profits is the difference between the stock price when the market opens and its price when the market closes. This routine is an excellent field for Machine Learning and automated trading software that uses ML patterns.

That’s why, developing and selling an AI solution in the form of a software product that is capable of recognizing most common patterns of increasing or decreasing the price during a day, has all the basic functions, a range of safe and versatile trading strategies and prediction models wrapped in a user-friendly interface is a solid strategy of using Artificial Intelligence for profits without personally engaging in stock trading.

Considering its target audience, such software should include manuals, a “practice mode,” useful tips, or even a separate module with relevant daily news and advice from reputable experts. The product owner and developers must carefully choose and implement the functionality, sets of core and additional features, and monetization strategy in order to make the software highly attractive to potential customers.

3. Developing and selling an advanced AI system for stock trading.

This course of action involves developing and selling an advanced AI solution designed to perform accurate forecasts for long-term investments instead of day trades. This activity is far more risky and usually requires more initial funds, yet the potential rewards can be vastly higher than the gain from day trades. For this reason, long-term investment in stocks requires a much more thorough planning, more accurate predictions, and thus demands a far more advanced AI trading system.

Building such a complex and multifunctional solution is not easy and requires a large team of highly skilled specialists and, as a consequence, significant payments. So, the resulting software won’t have a large variety of monetization options: it is going to be a rather expensive paid program and probably unaffordable for private users and small companies.

4. Developing a customized AI solution.

The last option in our list involves selling a unique, tailor-made AI solution built according to the strict specifications of a particular client, such as a huge investment company or a hedge fund. As a rule, custom solutions worth more than “general” ones as they are one-of-a-kind products and must include some features that are not available in similar products. Since you already have a client who is willing to pay, you won’t have to deal with all the marketing routines to promote the software, thus reducing its cost. On the other hand, you may sell such a product only once, and there is generally a one-time monetary reward after its release.

As you can see, there are two common courses of action if you are an owner of an AI solution for stock trading. You may enter a stock trading market and take your chances in trading and investing using the powerful capabilities of Artificial Intelligence to aid your activity. Alternatively, you may enter a software market with a reliable and user-friendly solution enhanced by AI and ML and sell it to stock traders.

However, if you develop (or order) an AI solution for stock trading to sell it subsequently to various traders and investors, there is still a high chance you will have to use it yourself. You will have to convince the potential customers that your software is a real deal and can make them rich (or richer), and the best way to achieve this is by showing your “success story.” So, as a marketing technique, you will have to make a portfolio of successful stock trades with sizeable profits using your software program to promote its sales. This method will convert more people than a simple listing of the benefits offered by your AI software or even aggressive advertising on topical websites or social media.

Why use custom software instead of ready-made solutions

Depending on intentions, goals, budget, and many other factors, both ready-made and custom solutions can be good to use for stock trading. Ready-made AI-driven software for stock trading is winning for those who just want to get money fast, without additional expenses and waiting. However, such easily accessible software is not suitable for high-capital investment companies, hedge funds, or any investors who pay extra attention to their privacy and business security. In this case, you need a powerful and unique product that would give you an advantage before your competitors.

Collecting data from trustworthy sources. You can create the list of top-quality and reputable sources of information and adjust it when needed. In case you create software for personal use, it becomes essential to select the sources of information to make sure the integrated Artificial Intelligence works with real unbiased information. If you purchase a ready-made software, you need to test it from top to bottom to make sure it won’t ruin your savings and reputation.

No surprises. AI stock trading software is a complex digital product, so you should rely its development to the hands of professional developers who will provide you with constant reporting on the software functioning, detailed documentation on the product, and commonly offer post-release assistance. You cannot have this level of confidence when using a ready-made AI software created by the unknown team.

Dashboard and charts are most convenient. Since custom software is always created to fully fit your needs, you will decide in what format and how often you get information on stock market condition and changes. Spreadsheets, diagrams, pie charts, and, basically, everything else that can be added to your software will be put there on your demand as long your idea is implementable.

Custom set of features and algorithms. If you want to make good money on your software for stock trading, it must be more powerful and unique than similar services already existing on the market. To leave your competitors far behind, you need to develop a combination of algorithms for searching patterns and deviations, analytics, forecasting calculations, etc.

Transparent testing results. The notorious case of Knight Capital showed the world that one coding error can kill the entire business in minutes. That is why thorough software testing is as important as its development. When you control or at least monitor the process of building your software, you also can control testing conditions, which is possible only if you create a custom product with a team you interviewed and hired.

Conclusion

As it became clear from this article, Artificial Intelligence is an incredibly powerful technology that may be effectively used for stock market trading. Even in its current state, AI is superior to human skills in many aspects involving data analysis, probability calculations, financial modeling, and a lot more. Unlike a human, AI won’t:

- burn out from routine work;

- make a mess intentionally;

- panic or get frustrated when something goes not as planned.