Fraudsters and their algorithms are like viruses, they evolve fast and get even more sophisticated each year. The only fraud prevention solution that can keep up with their speed is making fraud detection systems use machine learning or artificial intelligence techniques. In this article, I will cover such aspects as types of fraud in Fintech and how ML systems can eliminate them, benefits of using machine learning for fraud detection, developmental approaches, and things to focus on for a software owner. So, let’s begin!

Types of Fraud in Fintech and How ML Systems Detect Them

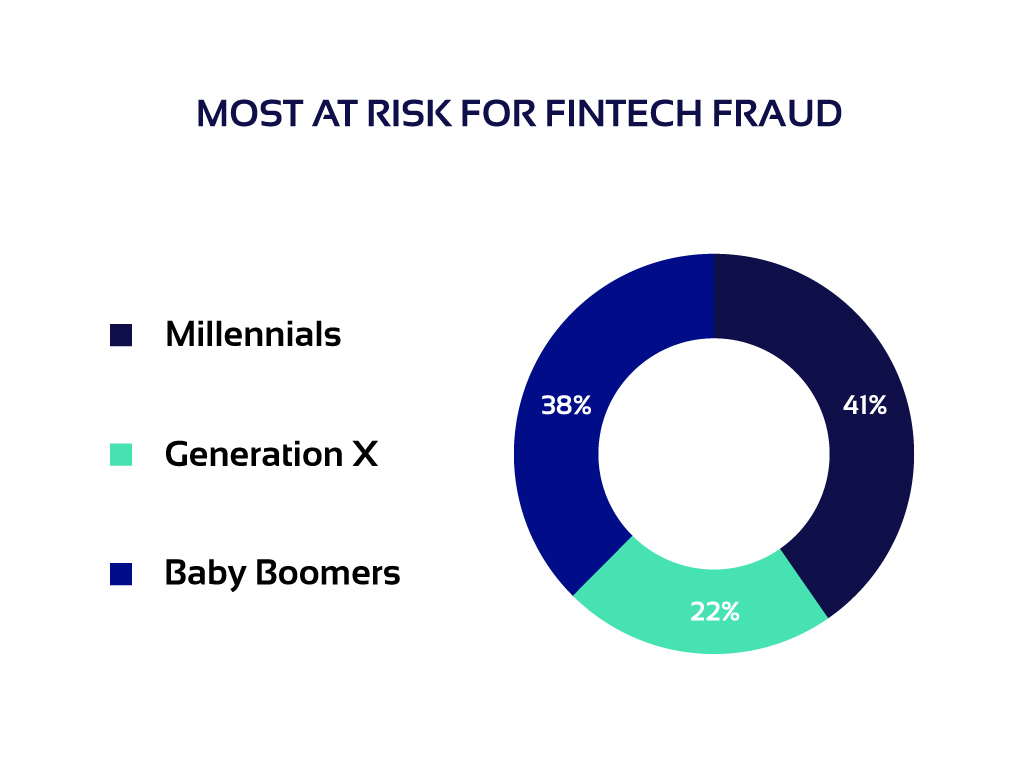

According to the North American Securities Administrators Association (NASAA) Baby Boomers and Millennials are most at risk for Fintech fraud activity.

However, there are also thousands of cases when a banking institution or a Fintech company becomes the victim and faces even bigger losses. The most common ways thousands of frauds try to get money from companies and individuals are:

- Insurance claims fraud;

- Loan fraud;

- Identity theft;

- Account theft;

- Money laundering;

- Credit card fraud;

- Mobile fraud;

- Internal fraud, etc.

All mentioned types of fraud in Fintech have certain peculiarities, but methods, approaches and algorithms to fight them are very similar. And yet, so far there are no one-size-fits-all solutions. Some cases like identity and account theft require text-oriented solutions that are able to process and analyze huge amounts of text from corporate catalogues, comments to the posts, etc. At the same time, there are plenty of image-based fraud detection problems that can be solved with ML-based technologies like OCR for image recognition.

In brief, an ML-based system receives or generates data on people, their behavior patterns, inconsistencies, etc. Then, by using algorithms, the system classifies data into groups marked as fraud, non-fraud, or possibly fraud, and presents the result in a required form such as report for managers, command to a third party systems, etc.

After the result is given, a person or their action can be permitted or declined automatically by an application (for example, when a person logs in or starts money transaction) or manually by the manager (for example, when approving or denying a loan application).

Reasons to Use Machine Learning and Custom Software in Fraud Detection

These benefits of using ML for detecting fraudulent activity are just a few from many.

Real-time processing speed

Time is one of the most valuable assets, especially when it comes to health and money. Depending on the capabilities of an ML-driven system, it can process data in real time and give the result within milliseconds. Comparing to manual check that may take days or weeks it significantly increases the speed of decision making and reporting.

High precision

When created and handled by the professional data scientists, ML-driven software has all required resources to provide financial institutions with a 99.97% accuracy of results. Trained managers also can provide an accurate result yet they will require more time and resources.

Forecasting abilities

The biggest advantage of ML-driven software is its forecasting abilities that can predict future workload, fraud scenarios, trends and patterns, and a lot more. In many cases, companies operating in the Fintech industry use machine learning for its smart data processing and decision making capabilities; however, integrating a forecasting functionality into the platform will give you a significant advantage over your competitors.

Among the most rewarding benefits a company can get with using proper custom software instead of ready-made solutions are full automation of processes, increased capacity, and automated database seeding.

Full automation

Automation will remain one of the biggest trends in business for years. Fraud detection machine learning algorithms and models can ensure full automation of various banking, loaning, insurance and other processes. Full automation can entirely eliminate human mistakes and internal fraud activity.

High-load capacity

A system that can process and store big data will guarantee its owner a winning performance on the market comparing to their competitors. However, even if at the moment you’re not planning to work with high-load, you should make your system scalable so your ML-based software could always have enough data and power for providing required quality and speed.

Advanced database seeding

Depending on the software functionality you can integrate multiple channels for data gathering. In addition to manually entered data, the system can automatically collect data from various sources or even generate it to increase the accuracy of fraud detection. The system can autonomously seek the sources of useful information and extract data from them to create extensive profiles for existing and future clients.

Things You Should Know and Focus on as an ML-based Software Owner

Security. Fintech is one of the industries with the highest need in data security. It doesn’t really matter whether you have a small startup or a huge financial corporation, data on all clients and transactions must be hidden and protected to the fullest.

Frauds who create complex algorithms for illegal financial schemes are very smart people, and they might find a way to damage your data so your fraud detection system won’t function the way it should.

Isolated environments, data encryption, multilevel access, and safe data storage are only a few things you need to include into your fraud detection system development to protect both software and hardware sides of your product.

Performance. Many banking and other financial institutions require a system that detects fraud at the moment of user registration, login, or payment transaction. In order not to affect user experience, all fraud detection processes must be invisible to the human eye and take milliseconds.

As a fraud detection product owner you need to make sure that your software is developed by the data science professionals because only they can guarantee that your ML system gives accurate results, possesses overtraining functionality, and can explain as well as justify its results.

Database. One of the biggest problems for developers who create fraud detection machine learning algorithms is not having enough data for educating the system. Thus, every financial institution that wants to get an ML-based fraud detection system of the best quality needs to be the one who gathers required confidential data.

Any trusted data science company that gained enough experience in creating such complex systems cannot take data they previously received from one client and use it for teaching an ML system of another client. As a future fraud detection software owner you should keep in mind that developers are allowed to take in progress only data they receive from you and from legal open-source services.

Thus, the quality of your ML-based fraud detection software depends on the quality of your initial database.

Development Approaches

The creation of fraud detection with machine learning solutions can be based on development approaches that differ by their work structure, architecture, methods, etc. The most known and used approaches are:

- Supervised learning;

- Unsupervised learning;

- Reinforcement learning.

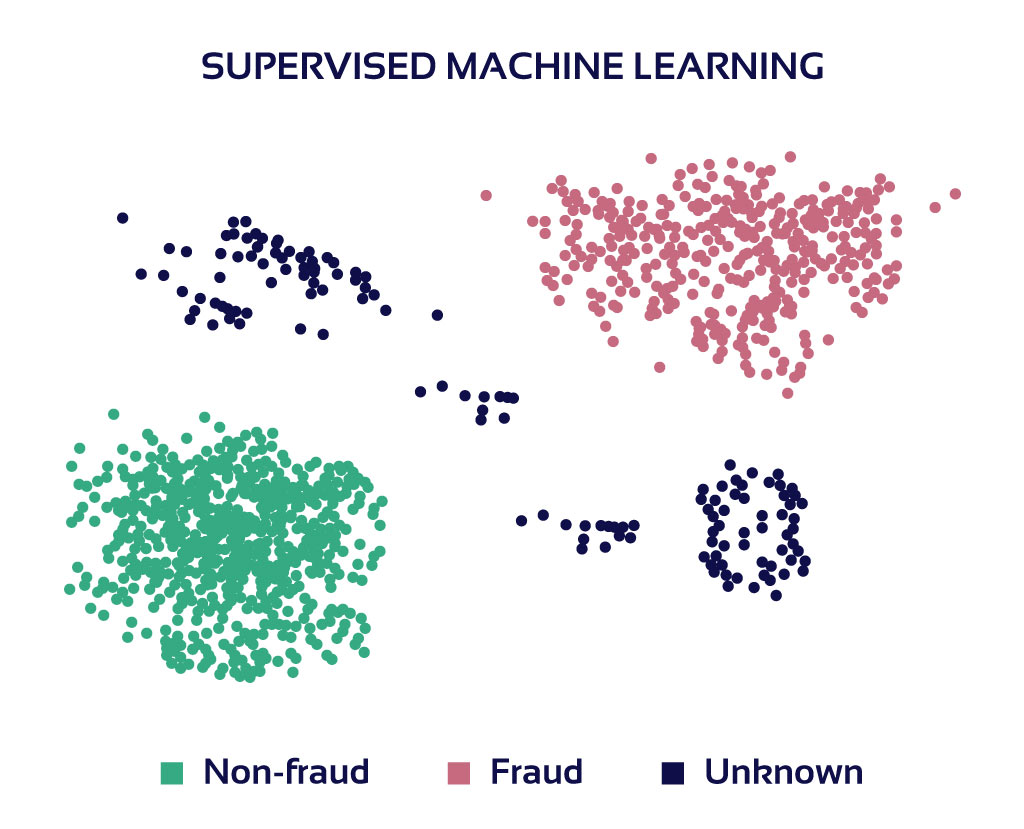

Supervised learning

Decades ago, when neural networks weren’t developed comparing to the ones we have today, deep learning was not a good option for creating fraud detection software. The main challenges development engineers faced were the huge size of models and a lack of computing power and scientific works. Because of these technical limitations specialists could use only statistical methods to detect fraudulent activity. Having no ability to use neural networks for machine learning they tried to clusterize data using statistics and various methods such as attributing, decision trees, regression and others for prediction and marking data as fraud or not fraud.

The vast majority of machine learning models that could be used for business needs were big and simple. These models didn’t have complex links, and included:

- set of attributes required for building several clusters with “good” and “bad” data;

- hyperspace for each set of attributes to define which cluster they should go to.

The reason why this approach is called supervised lies in the fact that ML systems need to learn from their own mistakes, just like human students and need many real-life examples on different kinds of transactions (valid, false, etc.). Thus, along with many other things, engineers must give the machine historical data divided into separate groups specified as “important” and “not important” so that it could detect inconsistencies and irregularities.

The supervised learning approach had two big problems – precision of results and the speed of model obsolescence; and another problem, which often derived from trying to solve them – no servers with enough memory and capacity to handle the model. Because of high demands towards the system’s precision and response speed, models became too complex for equipment available at that time to process. Since there was no single hardware that could handle the statistics-based ML processes, one model had to be split and placed into several servers. Needless to say that it was highly challenging because all model pieces and their hosting servers had to work in a flawless sync, which was expensive in terms of cost and time. As a solution to this problem, software engineers created complex cashing systems to achieve smooth and well-coordinated functioning.

Luckily, the world of information technology continues to evolve, which allows developers to move from detecting strong dependencies to working with chains of weak classifiers. By using so-called trees these classifiers can be adjusted to detect hardly noticeable correlations.

This approach to fraud detection is good for the Fintech industry because business owners want to understand the logics of machine’s decisions. In this case, statistical methods are beneficial because they are self-explanatory. Still, they fit only a limited number of problems and goals.

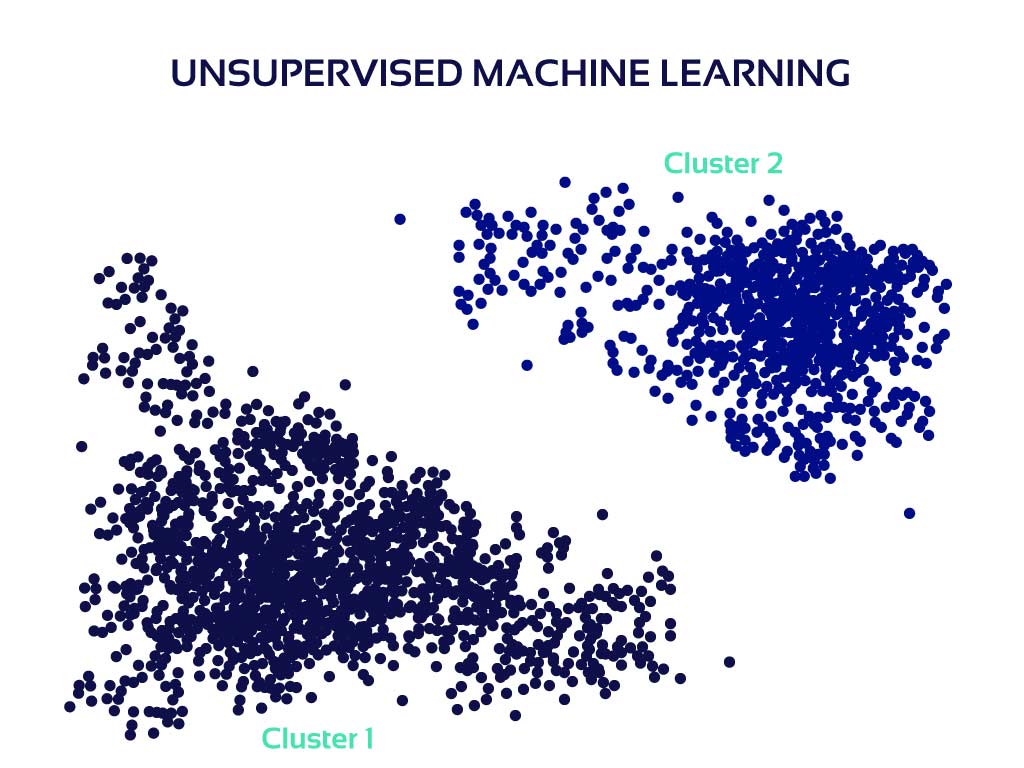

Unsupervised learning

Unlike supervised learning this approach is based on deep learning techniques. If talking about statistics models, it should be pointed out that all features created by the software engineers are based on their intuition, experience and diligence in trying to detect hidden correlations, implement unorthodox metrics and logarithms, etc. Still, all these actions are intuitive to a large extent.

When it comes to deep learning, specialists’ intuition is replaced by the machine that is able to process more variants and take into account more details a human would very likely leave unnoticed or consider irrelevant. After it became vivid that deep learning implementation started showing more accurate practical results, this method became more convenient to use and the infrastructure got more standardized this approach gained popularity in the fraud detection practice.

GAN (generative adversarial network) is one of modern approaches and implies creating two neural networks – one for generating various attributes that can be provided by the real users, and another one for distinguishing true data from false. Thus, first, developers create fraudulent software, and only then – an anti-fraud system.

Also, with the help of RNN (recurrent neural network) and LSTM (long short-term memory) neural networks, engineers gained the ability to go deeper into the user zone and train the system by using attribute sequences to create individual digital replicas of real users and immediately get required data instead of collecting it manually.

Today, Deep Learning is a common practice in fraud detection.

The unsupervised learning approach is the most desired to use because the fraud detection field has a huge problem – the aforementioned lack of data. No company wants to share its information on transactions and other financial activity, which is understandable. In addition to the deficiency of data marked as commercial secret it must be homogeneous for accurate classification.

Unsupervised learning does not require external data to detect user patterns, inconsistencies, and anomalies, which is cool, but there are not so many specialists who are really great at creating this kind of stuff. When creating fraud detection platforms using the unsupervised approach engineers often base their work on personal intuition. However, specialists who have the best “intuition” also have years of hard work and scientific studies.

This approach is still far from being a perfect solution for identifying fraud because at the development stage it is difficult to understand how good it will work in a specific real-life case. Unlike with statistics-based learning where you can use historical data as a proof that the system works correctly at least for a short period, unsupervised learning is basically a set of suggestions that may or may not work.

To sum up, the unsupervised model elements help to solve the problem with data dependency and today it is a common practice to use them for detecting fraud in Fintech and other industries.

Reinforcement learning

We live in a dynamic world that evolves fast, and fraudsters are among the first ones to read all the news and scientific works. Once a new solution for fraud appears, you can be sure that they will immediately try to adjust their algorithms and adapt to changes to stay active and unnoticed.

Machine learning models for fraud detection that were created 5 years ago don’t work today. Even if at the early development stage the testing results show 90% accuracy when models move to the production stage their accuracy drops down to at least 85%, and in two years after the product is launched there is already a vital necessity in writing a new model.

Fraud detection systems often have additional integrated solutions such as http fingerprinting to eliminate the possibility of filling database with bot generated data.

To leave fraudsters no choice but to end their illegal activity it is most effective to use reinforcement learning approach. Such models allow fraud detection system to maintain full functioning while including new training data into learning processes. Thus, the system can autonomously take new information from real cases to add new features to its functionality for constant self improvement. Thus, the system becomes able to autonomously maintain its functionality and relevancy for many years, which is highly beneficial for business and its safety.

Final Words of Advice

If you are new to fraud detection in Fintech and you are a startup with a limited budget, consult with a trusted specialist on whether you should get a custom ML system from the start or try using a set of ready-made solutions. When a new client comes to us for an MVP product development, if we see that a stack of good ready-made solutions would be more efficient than creating custom software at this early stage we help to select and integrate the ones that fit client’s business needs. And after the client sees that their MVP is viable and attracts investments, they come back to us for a top-quality custom solution for fraud detection. If you’re a Fintech company or a startup and want to protect yourself and your clients from fraudsters, contact us and we’ll solve this problem for you!