Modern clients exhibit heightened awareness of their value for the banks and a developed appreciation for quick, comfortable, and paperless services. They also understand that there are many options and that they are free to choose whichever bank they want. Should a lending organization fail to process a loan application within the expected timeframe, customers swiftly pivot to alternative institutions capable of providing prompt application updates. Quick loan approval becomes even more essential considering the time-sensitive nature of loan requests. Banks and financial entities must acknowledge that customer loyalty depends on convenience, not just competitive interest rates.

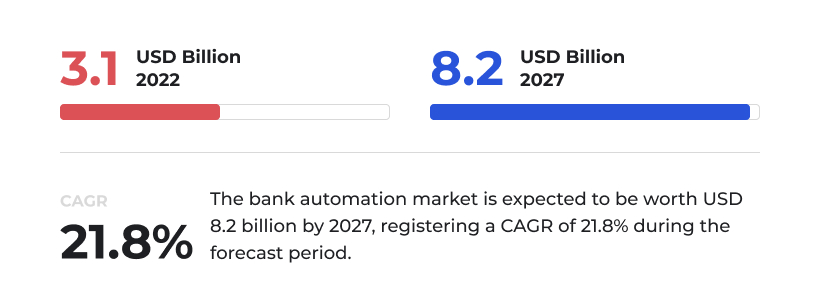

Loan automation and automatic loan processing become indispensable assets for banking institutions on top of the food chain. For that reason, the global bank automation market is expected to reach $8.2 billion in value by 2027 at a CAGR of 21.8%. And this is not just an impressive number; it is your alarm bell to start a digital transformation journey, and develop an automated loan application process that would outdo the competition and guarantee customer loyalty.

In today’s article, we are going to take a close look at loan automation, the peculiarities of an automated loan processing system, and see how your financial institution can benefit from implementing modern automation tools.

Automated Loan Processing Explained

Gone are the days of long and tiresome waits for loan approvals. With shifts in consumer behavior, perceptions surrounding loan applications have undergone significant transformations. Previously, clients viewed bank loans as something they had to endure and struggle for, something a bank gave almost as an act of generosity. However, as consumer awareness has grown, loans are now perceived as services offered by various lending entities. That is where automated loan processing systems come into the picture.

An automated loan processing system utilizes modern software powered by the latest cloud and web technologies to modernize and automate every stage of the loan cycle. In contrast to traditional legacy systems, this automated solution offers immense processing capabilities and eliminates the need for redundant paperwork or in-person interactions. It facilitates the streamlining of the loan system by swiftly identifying applications that align with lending criteria, conducting efficient underwriting, and sending funds.

Moreover, it enhances the overall accuracy of decision-making and security. An automated loan management system provides enhanced security features along with a 24/7 online support system, introducing a novel approach to loan management.

By implementing a robust loan automation system, institutions can swiftly screen thousands of loan applications within minutes, thereby enhancing overall customer satisfaction significantly. And on top of that, they can reduce the chance of error in decision-making, improving the overall security of funds.

Now that we have discussed the basics, let us dive deeper into the banking process automation and see which processes can be automated and what kind of impact such automations could produce.

Loan Processes that Can Be Automated

With the accelerating rates of automation within the finance and banking industry more and more lending institutions try to hop on that train. The rising popularity of automated loan solutions is attributed to their capacity to enhance various key aspects of lending. But, it is essential to understand exactly which processes can be automated and which processes should be automated first. Here are a couple of examples:

- Loan application processing: Accelerated capture and processing of digital and paper loan applications, ranging from 2 to 25 times faster, facilitated by Robotic Process Automation (RPA), Machine Learning (ML), and advanced image analysis technologies. The acceleration rates would also depend on the automation readiness of each particular organization, so you have to be aware of that.

- Loan underwriting: Swift borrower risk assessment, reducing the average loan cycle time from days to minutes, and ensuring precise loan approval process through AI-driven risk analytics, fraud detection, and loan decisioning.

- Loan agreement management: Streamlined creation of loan agreements, leading to increased issuing speeds. AI-driven recommendations for optimal loan pricing can also be applied to maximize profitability. Such recommendations could be used to apply flexible prices for different categories of borrowers depending on the size of the loan and the payback speed.

- Loan repayment management: Complete transparency regarding both active and settled loans, alongside automated debt collection processes, resulting in a potential increase in the productivity of loan servicing teams.

- Borrower engagement: Efficient handling of borrower requests across various channels, with intelligent chatbots automatically providing clients with loan-related information. That way you can process inquiries across different platforms, such as websites, mobile apps, phone calls, and more.

- Regulatory adherence: Ensuring compliance with mandated lending regulations and achieving increased regulatory reporting speeds, all thanks to automated compliance checks. Of course, this is one of the more complicated processes to automate, but it would produce a critical impact upon your operations.

You can automate other processes too, but the ones listed above would produce the most noticeable impact on your operations. Usually, your digital transformation partner would help you analyze and select the potential automation candidates or the processes that would be the fastest, the easiest, and the most impactful to automate. From there, you and your partner can move on to automate further processes.

Key Features of High-Quality Loan Automation Systems

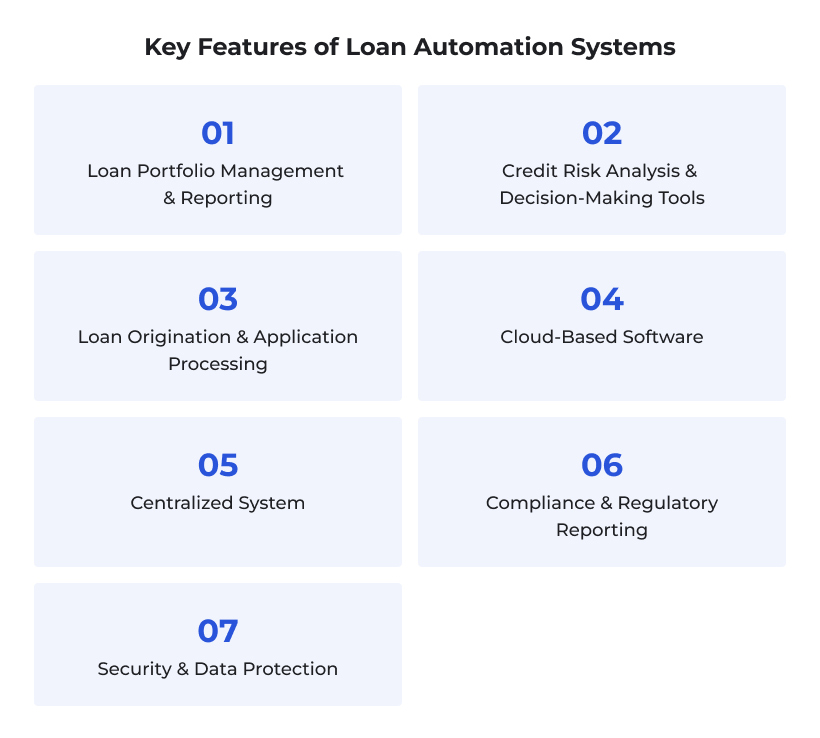

Employing an automated loan system to oversee all your loan processes can bring forth swiftness, precision, and expansion to your financial institution. Nevertheless, it necessitates an outstanding loan automation system to fulfill your expectations. Here are the key features to consider.

Loan portfolio management and reporting

For a loan management system to be truly effective, it must offer comprehensive reporting and analytics capabilities. This entails providing lenders with access to extensive data concerning their loan portfolio, encompassing aspects like loan performance, loan approval rates, credit history, delinquency rates, and borrower demographics. Armed with such insights, lenders can make informed decisions regarding their lending practices and identify areas for improvement.

Furthermore, robust reporting and analytics aid lenders in meeting regulatory requirements and offer transparency to investors and stakeholders. The system empowers lenders to generate reports that validate compliance with various mandates and effectively manage their loan portfolios.

Credit risk analysis and decision-making tools

Efficient credit assessment and analysis are crucial for the success of any lending venture. Smooth operation of your lending activities can be brought down by inaccurate data or delays in evaluating borrowers' creditworthiness. It is imperative to procure a loan management system capable of accurately appraising the creditworthiness of applicants. By automating this process, you can swiftly and accurately determine the most suitable loan products for each applicant, thereby mitigating the risk of missed paybacks.

A robust automated system should furnish precise credit risk data and analysis, enabling you to assess the creditworthiness of each customer and make informed lending decisions. This may involve aggregating information from multiple credit bureaus and singling out relevant data. Ideally, your system should offer these integrations, enhancing efficiency and presenting a comprehensive view of each applicant's creditworthiness. That way, you can assess each applicant and make the most suitable data-driven decision within seconds time.

Loan origination and application processing

Prioritizing loan origination and application processing is paramount when choosing or developing a loan automation system. A primary advantage of leveraging such a system is its ability to expedite the acceptance and processing of loan applications, granting lenders a significant edge in terms of speed.

Your system should boast customizable application forms, document management utilities, and automated credit checks to ensure streamlined processing. This will enable you to save time, reduce errors, and enhance the efficiency of your lending process. Furthermore, it's crucial to recognize that every business has unique requirements, necessitating a loan management system that is dynamic and adaptable to meet the specific lending needs of your financial institution. As a lender, you should have the capability to devise and offer loan products tailored to the individual requirements of each customer.

Cloud-based software

Utilizing cloud-based software for debt administration can streamline issue processing for lenders. It ensures rapid adoption, offers software flexibility, allows easy access to support from your cloud provider, and often includes regular upgrades and automatic updates. Moreover, the cloud facilitates access to the program from any location with internet connectivity, enabling faster retrieval of information.

Centralized system

Lenders must address various modules, including onboarding, credit assessment, underwriting, and funding, to complete the lending cycle. However, a prevalent challenge in the lending sector is the reliance on multiple software solutions to execute all lending activities. Often, lenders utilize separate systems for credit analysis, loan origination, and payouts and recovery. Your ideal loan automation system should enable you to execute the entire lending process within a unified system.

This approach enables you to cater to more SMEs and small businesses without escalating costs associated with multiple systems. Additionally, a centralized system facilitates the storage and retrieval of borrowers' data, streamlining subsequent lending processes.

By possessing a system that incorporates all these modules within the platform, supports customizable modules, or facilitates integration of third-party applications, you can alleviate most of these burdens, save time for your team, and enrich the customer experience. Consequently, this becomes an indispensable feature when designing the optimal loan system. A centralized system empowers you to monitor all lending activities, comprehend customers' requirements, and deliver appropriate products to them.

Compliance and regulatory reporting

Compliance is paramount across the entire financial sector, particularly in lending, where adherence to essential regulations is crucial to avoid penalties. Your automated system should facilitate compliance with all regulatory requirements and reporting obligations. It should enable effortless generation of reports, loan portfolios, and default tracking while ensuring regulatory compliance. Most importantly, your system must consistently adhere to data privacy, consumer protection, and anti-money laundering laws.

Security and data protection

Compromising on security and data protection in the lending industry is never a good idea. Your automated loan processing system should possess robust security features to safeguard the sensitive data of both you and your borrowers, thereby preventing fraud or unauthorized access.

Your system must have excellent security measures, such as encryption, multi-factor authentication, and user access controls.

Major Benefits of Loan Process Automation

Lending represents a critical service area for any financial institution due to its time-consuming, rule-based, and process-driven nature, making it ripe for automation. Automation plays a pivotal role in maximizing the efficiency of various tasks integral to the lending process, spanning from loan initiation to document processing to quality control and beyond. This translates to increased loan application approval speeds and ultimately leads to heightened levels of customer satisfaction.

Traditional loan lending processes often involve extensive paperwork that must be processed throughout various departments within an organization. This manual handling can lead to bottlenecks in areas like the contact center, back office, and even payroll.

Benefits of this automation include:

- Enhanced compliance: A detailed audit trail and embedded checks promptly notify customers and lending institutions of any errors or omissions in the process, allowing for timely resolution.

- Reduced operational costs: Time previously dedicated to processing paperwork and managing documents can now be redirected towards customer interactions and resolving more intricate issues, tasks better suited to the expertise of staff.

- Error elimination: Manual data entry, a common practice before, during, and after loan approval, is highly susceptible to errors. Loan lending automation removes the need for human intervention, thus mitigating the risk of costly and time-consuming mistakes.

- Intelligent document processing: Through loan lending automation, machine learning, and artificial intelligence collaborate to extract additional data from various documents, standardize information into templates, and swiftly update all relevant databases.

- Increased efficiencies: Loan lending bots are capable of managing routine decisions in the loan origination process, allowing seasoned employees to focus on handling exceptions and fulfilling requests.

- Omnichannel capabilities: Documents and information can be gathered from virtually any device or location and seamlessly integrated into the bank's network, valuation systems, pricing automation, or preferred databases. This restructuring and updating occurs automatically, without requiring manual intervention.

Tasks such as engaging with stakeholders, onboarding mortgage loan customers, conducting credit scoring, and maintaining high levels of customer satisfaction require significant time investment. By automating workflows, the loan lending process becomes more efficient for both lenders and borrowers.

Legal Restrictions to Pay Attention To

When developing loan automation software, you must adhere to legal compliance frameworks to ensure regulatory alignment and mitigate legal risks. One of the foremost frameworks to consider is consumer protection legislation, which encompasses laws governing fair lending practices, anti-discrimination measures, and disclosures of loan terms and fees. Additionally, data protection and privacy regulations are paramount considerations in automated loan decisioning software development.

Compliance with laws like the General Data Protection Regulation (GDPR) in Europe or the California Consumer Privacy Act (CCPA) in the United States is essential to safeguarding the confidentiality and integrity of borrowers' personal and financial information. Implementing robust data encryption, access controls, and secure data storage mechanisms are vital steps to ensure compliance with these regulations and prevent unauthorized access or data breaches.

Furthermore, financial regulatory frameworks, such as those set forth by regulatory bodies like the Consumer Financial Protection Bureau (CFPB) in the U.S. or the Financial Conduct Authority (FCA) in the UK, impose strict requirements on financial institutions regarding risk management, disclosures, and reporting.

Ensuring adherence to these regulations in the development of automated loan decisioning software is crucial to maintaining the integrity of financial systems and protecting consumers from predatory lending practices. By integrating compliance measures into the entire process of software development from inception, developers can mitigate legal risks and build trust with both regulators and consumers in the lending industry.

Final Thoughts

In 2024, the significance of automating the landing process cannot be overstated for business owners. While it often entails substantial changes to business processes, it also yields numerous benefits. However, implementing automation is neither a simple nor swift endeavor, and entrepreneurs may find themselves inundated with myriad offers, vendors, and solutions in the market.

With a track record spanning over 15 years and having successfully completed hundreds of projects, Light IT Global stands poised to offer comprehensive guidance, estimation, and a tailored action plan to address your business requirements. If automation software tailored for the lending industry piques your interest, do not hesitate to reach out and schedule your complimentary consultation with us! Now is the time for you to harness the advantages of automation!